THE ADVANTAGES OF B2B PORTAGE

Wage portage is the ideal solution for companies of all sizes that want to call on external skills: consultants work autonomously on your behalf. These consultants are employed by a third party, the portage company. This system offers many advantages for managing your service providers.

The system is flexible and easy to set up

Wage portage is ideal for companies working in project mode that regularly need expert support. Companies can activate the wage portage system within 48 hours, and the set-up process is very simple.

Keep your payroll under control

You can add to your team without increasing your payroll. Freelance contractors are service providers and are therefore not part of your workforce. This enables you to expand your skills base during times of economic uncertainty, or when your hiring capacity is limited.

Keep your costs under control

Reduce the cost of external services: a portage company charges a much lower margin than other service providers, such as Digital Service Companies (ESN) and temporary employment agencies (generally between 15 and 30%). You negotiate fees directly with your consultants, and we support you by making sure that your interests are aligned with the interests of your consultants.

Keep your economic, legal and reputational risks under control

- No economic dependence

- No risk of requalification

- No supervisory relationship

→ The consultants who are working on assignment at your company are our employees, so there can be no illegal subcontracting or unlawful lending of labor.

The experts, the external consultants who perform their tasks for your company on a portage basis are service providers. As a result, you cannot be held liable for illegal subcontracting or unlawful lending of labor, because the experts are employees of the portage company. Furthermore, none of your company’s social provisions apply to your relationship with these consultants. The rules governing your company’s employees are not extended to these service providers, because they are employees of the Employer of Record (EOR). They do not have the same rights and obligations that the employees of your company have.

WHAT IS WAGE PORTAGE?

By definition, wage portage is a new form of employment halfway between salaried employment and entrepreneurship. This status allows you to develop an independent professional activity, while still being covered by social security under French law in the same way as a traditional employee.

As employees, consultants receive a salary under the wage portage system. This salary is paid to these consultants by their employer, i.e., the Employer Of Record (EOR).

The EOR provides administrative support for these employees.

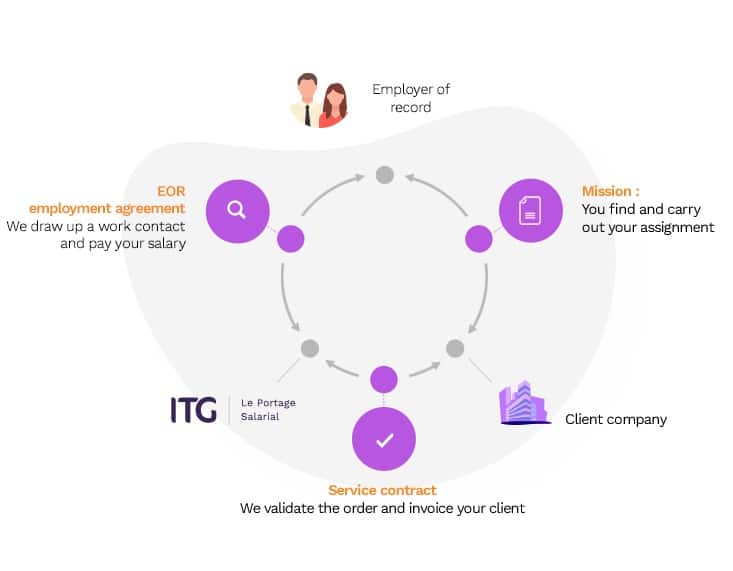

Wage portage is a tripartite relationship that requires two contracts to be drawn up:

As a preliminary step, the general conditions of membership define the terms of the collaboration between the EOR and the self-employed consultant.

The service contract between the EOR and the client determines the terms and conditions of the assignment negotiated by the employee. As the service provider, the EOR assumes civil liability for the assignment and can therefore offer an employment contract that defines the scope of the assignment. A permanent or temporary employment contract gives the consultant the status of a ported employee, along with the corresponding social benefits.

HOW DOES WAGE PORTAGE WORK?

According to Article L1251-1 of the French Labor Code, wage portage is a tripartite contractual relationship in which a self-employed consultant with the status of a ported employee of the EOR provides a service requested by client companies.

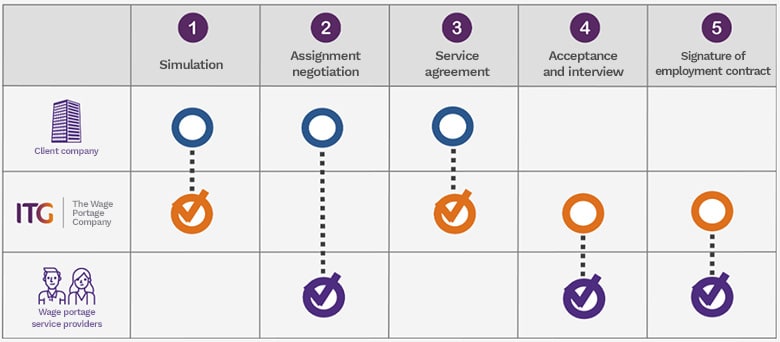

Portage brings together three players, as shown in the diagram:

- The client may be a French or an international company, a government agency, a local authority or an association.

- The « ported » consultant, who is an expert in one or more fields and carries out the assignment negotiated with the client company.

- The EOR, which ports the consultant’s assignment and pays the consultant’s salary. The EOR draws up the contracts with each of the other two parties and handles all the administrative tasks.

CORPORATE CLIENTS

Obligations towards the ported employee

A company can call on a ported employee to meet an occasional need if the company does not have the necessary qualifications in-house, or if this activity is not part of the company’s core business. However, the company may not use this form of employment to replace an employee who is on strike or who cannot be present at work for other reasons.

The French Labor Code also states that a ported employee may not be entrusted with a particularly dangerous assignment. Moreover, the client company must ensure the health and safety of the independent consultant during the assignment. Finally, the law sets the duration of the provision of service at 36 months.

Obligations toward the EOR

The ported employee and the client company agree on the terms and conditions of the assignment. However, having signed a commercial contract for the provision of services, the client company has obligations towards the EOR. Under the contract, the client company has two main obligations toward the EOR. It must:

- Pay in full to the EOR the price of the service agreed with the ported employee in accordance with the schedule set out in the contract;

- Notify the EOR of any event that could disrupt the smooth running of the assignment being carried out by the ported professional.

Penalties applicable to the client company

Failure to comply with the above provisions is punishable by a fine of €3,750, as is failure to include the mandatory information in the commercial contract, or failure to sign a commercial contract with the EOR within two working days of the start of the service. The penalty is increased to €7,500 in the event of a repeat offense. Ignoring this prohibition can result in a fine of €6,000 and six months’ imprisonment.

THE STATUS OF PORTED EMPLOYEES WITH ITG

Article L1254-2 of the French Labor Code and Article 2 of the Collective Agreement for Ported Employees (IDCC 3219) set out the conditions for eligibility for this status. Since July 1, 2017, a minimum Level III professional qualification (two or more years of higher education) is required, or failing this, three or more years of experience in the business sector. Their skills enable them to analyze problems, and to develop and implement solutions. Ported employees must also have sufficient autonomy to search for new assignments and negotiate the terms and conditions of their services and the price with potential clients.

Their remuneration may vary depending on the type of employment contract and the activity:

- A minimum monthly salary equivalent to 75% of the monthly Social Security ceiling (€2,568 gross in 2021) or another amount set by an industry-wide agreement;

- A business contribution allowance at a rate of 5% of the gross monthly remuneration. a job insecurity allowance: 10% of the total gross remuneration paid to ported consultants working under a temporary contract;

A reserve: 10% of the base salary of the last assignment for employees working under a permanent contract, set aside in the consultant’s activity account to compensate for partial or total loss of income during the period between two assignments.

Under certain conditions, wage portage entitles workers to receive unemployment benefits in the event of dismissal, expiry of the employment contract, or termination of the employment contract by mutual agreement.

What is an EOR ?

By definition, an EOR is both a service provider for client companies and the employer of freelance consultants. The EOR places its organization and resources at the disposal of these professional consultants and supports them in developing their activities. However, these consultants are completely free to choose the assignments they wish to work on and to determine how they will carry them out (time management, work location).

The EOR is paid a management fee for the administrative, accounting and legal tasks involved in the independent consultant’s activities.

The obligations of the EOR

The EOR must comply with certain rules. It must:

- Invoice these services to the client, according to the terms agreed between the client and the ported employee;

- Pay a salary to the ported consultant, after deducting the consultant’s personal expenses and social security contributions;

- Create and provide an activity account for the consultant at least once a month. This document details the various amounts: the payments made by each client for services, less management fees, the professional costs of wage portage and pay slips (social security deductions, taxes, net salary, etc.).

- Pay employee and employer contributions and make tax declarations to the relevant administrative bodies;

- Take out professional liability insurance on behalf of the ported worker;

- Obtain a financial guarantee from an organization authorized to issue sureties to guarantee payment of ported employees and social security contributions;

- Verify the job applicant’s qualifications and skills, and that their profile is appropriate for the desired activity;

- Provide medical supervision for ported employees.

Penalties applicable to an EOR

An EOR is liable to a financial penalty of €3,750 if it fails to comply with the following regulatory provisions:

- Failure to provide the mandatory information in the portage contract: specifying the nature of the contract (temporary or permanent), the minimum or exact duration for a temporary contract;

- Failure to forward the employment contract to the employee within two days of signing;

- Exceeding the maximum duration of the temporary contract;

- Failure to open an activity account for each ported worker.

- Failure to take out the mandatory financial guarantee.

- Failure to declare the activity in advance.

- Failure to comply with obligations relating to the occupational health of ported employees.

In its relationship with the client, the EOR will incur the same penalty if it is guilty of the following acts:

- Signing a contract with a company providing personal services.

- Failure to sign the contract within two working days of the start of the service, with a copy sent to the employee within the same period.

- Failure to provide the mandatory information in the commercial contract.

- Repeat offenses of any kind are punishable by a double fine and six months’ imprisonment. The judge may also prohibit the exercise of wage portage activities for a period ranging from two to 10 years. Failure to comply with this prohibition could result in a €6,000 fine and six months’ imprisonment.

WHAT ARE THE SPECIFIC FEATURES OF THE WAGE PORTAGE CONTRACT?

An employment contract under French wage portage law may be temporary or permanent, depending on the number and duration of assignments. Temporary or permanent contracts provide the same social protection as conventional employment contracts, and their contents are similar.

There are, however, three significant differences:

- There is no supervisory relationship between the ported employee and the client company.

- The EOR is not required to provide work for the consultants, who must therefore find their own assignments to avoid any interruption in their income.

- The EOR does not have to pay the ported employee a salary between assignments.

THE SEVEN ADVANTAGES OF WAGE PORTAGE

You save time

Become self-employed in 24 hours, without having to worry about management. The EOR handles 100% of your administrative tasks. You can concentrate on completing your assignments and developing your business!

You benefit from employee protection

With wage portage, you are independent and protected! You are covered by social security, third-party liability insurance and an advantageous health insurance plan… You contribute to your pension and secure your access to unemployment benefits.

You can search for and find assignments

Find new clients and gain access to major accounts with our wage portage services. You benefit from the credibility, advice and referencing of a recognized company.

Reduce your risk in France or abroad

With wage portage, you can carry out assignments for companies in France or abroad without setting up your own company. We take care of all the administrative tasks and sign the service contract with the international client.

You also reduce the risk of reclassification, because you already have a contractual relationship with an employer of reference, and there is no supervisory relationship between the ported employee and the client company.

Access to training

Just because you’re independent doesn’t mean you don’t need training – quite the contrary! With wage portage, you can earn training entitlements and access certification courses to help you develop your freelance activities and boost your sales.

You are independent but never alone!

An EOR is a true talent incubator. Join a community of consultants to create synergies and expand your network. Rely on the advice of a dedicated contact who can quickly answer all your questions.

Easier access to credit

Wage portage makes it easier to obtain a bank loan. A temporary or permanent employment contract offers financial stability to the self-employed worker and helps to reassure banks. The contract is a guarantee of professional stability and a fixed monthly income, in line with the provisions of the collective agreement governing this form of employment. The entitlement to health insurance and unemployment benefits protects their budget in the event of any unexpected problems, and enables consultants to continue making their monthly installments.

WHO CAN BENEFIT FROM WAGE PORTAGE?

Wage portage and executive employees

With wage portage, executive employees can set up their own businesses with less social and financial risk, whether or not they plan to set up a company later. This status is also ideal for enhancing your skills and making it easier to return to salaried employment, or for developing your network and pursuing a freelance career. What’s more, since the EOR handles all the administrative tasks, consultants can fully devote themselves to their assignments and maximize their income.

Wage portage and employees who are training to enter a new profession

Many people in France are changing careers in order to find a profession or status that better matches their aspirations, or because of changes in the current economy. Wage portage is the ideal way to retain the advantages of employee status, while making a flexible transition to working independently or to entrepreneurship.

Wage portage and entrepreneurs

Before setting up your own company, it’s a good idea to test the relevance and feasibility of your plans and to conduct a market study (competition, prices, constraints, client expectations, etc.). Wage portage allows you to begin this essential preparatory phase in complete safety.

No complex procedures or major investments are necessary.

Employees continue to benefit from social security (health, retirement and unemployment) because these contributions are deducted.

Employees no longer have to handle billing and administrative tasks.

They can develop their client portfolios through the EOR’s network.

Wage portage and independent and freelance workers

Unlike an auto-entrepreneurship or a one-person company, wage portage avoids potentially burdensome procedures and investments. While enjoying a great deal of freedom, ported consultants still benefit from the same social security system as salaried employees (social security, health insurance, unemployment insurance), which is not provided for by other statuses.

Because the EOR handles the administrative tasks and provides support, you can concentrate on developing your business. Last but not least, belonging to a community of consultants increases your chances of finding new assignments.

Wage portage and auto-entrepreneurs

Using wage portage for auto-entrepreneurs allows you to:

- Have a solution when you reach your sales ceiling.

- Optimize your income by re-invoicing or reimbursing your business expenses.

- Be free from administrative hassles and cash-flow problems, because the EOR bears the financial risks.

But the biggest advantage of ported employee status over auto-entrepreneur status is the social security coverage: your medical expenses are covered by the general health insurance plan; you have unemployment insurance, and you have access to health insurance at special rates. The EOR also takes out professional liability insurance to cover consultant assignments up to a limit of 10,000,000 euros.

Wage portage is recommended for taking on short-term assignments, simply to test your entrepreneurial plans.

Wage portage and retirement

Increasingly more seniors are combining wage portage with retirement as a way to share their expertise, to stay active or to supplement their income without having to worry about administrative tasks. Combining a pension and income from paid employment is authorized up to a limit of 1.6 minimum wages (i.e. €2,487.33 in 2021), or up to the average of the last three salaries received before retirement.

Not only that, but your social rights are not affected. By continuing to pay contributions, you can accrue additional quarters to qualify for a full-rate pension, avoid having your premiums adjusted and benefit from the 10 to 30% increase provided by the supplementary pension plan.

Wage portage and recent graduates

Wage portage allows young professionals to start out in the world of work with relatively little professional experience, and to strengthen their skills while building up their client base and network of partners. The status of ported consultant can be a springboard to entrepreneurship, after these graduates have gained more experience and are ready to take on the heavier administrative tasks and constraints, and are able to provide the necessary financial capital.

In addition to social rights (health, pension contributions, paid leave, etc.), ported employees benefit from training on subjects such as looking for new clients, negotiation, drawing up commercial offers and pricing. They can also participate in events that promote dialog between the company’s consultants and companies in different industries.

Wage portage and international consultants

The EOR is responsible for all administrative and accounting tasks, because local regulations can be very complex. From a taxation point of view, partial or total exemption from income tax is possible in certain European Union countries.

What’s more, even if ported employees are based outside their home countries for short or long periods, they can continue to enjoy social benefits under the basic French system, especially about to unemployment and retirement. Finally, even from a distance, they can count on the support of the EOR.

Wage portage and job seekers

The law authorizes the combination of wage portage and unemployment. Job seekers can therefore benefit from the Return to Work Allowance (ARE) with a reduced paid activity. They receive a monthly salary and a pay slip. The risk is borne entirely by the EOR, which manages the administrative tasks, takes out professional liability insurance covering all its ported employees and guarantees that they are paid, even in the event of default by the client company.

Another crucial factor is that employees continue to have social protection: health insurance, life insurance, supplementary health insurance, pension rights and, under certain conditions, unemployment insurance.

WHICH JOBS CAN BE PERFORMED ON A WAGE PORTAGE BASIS?

Wage portage is particularly advantageous for consultants who offer intellectual services such as consulting, training and expertise or auditing. There are many eligible professions:

- Human resources: recruitment, contract termination, reorganization, conflict management, psychosocial risk prevention, coaching, training and more.

- Administrative management: administrative assistance and secretarial work

- Marketing, communication: business development and telemarketing

- IT and digital wage portage (including web marketing): data analysts/scientists, application developers, IT project managers, SEA or SEO experts, webmasters, content managers, social media managers and traffic managers

- Finance: financial advisors and accountants

- Management: interim management, merger and acquisition consulting

- Real estate wage portage: real estate agents, real estate brokers, real estate negotiators

- Trainers and coaches

- And many other types of expertise…

HOW DOES INTERNATIONAL WAGE PORTAGE WORK?

Professionals with solid expertise in consulting can offer their services to companies outside France. They can carry out their assignments for foreign clients while still in France, or go abroad for varying lengths of time.

By opting for international wage portage, which implies a « secondment » with no change in social and tax status, professionals can retain their health insurance, unemployment benefits, pension contributions, etc. Compared to expatriation, the administrative issues are simpler, and are managed by the employer of reference.

WHAT ARE THE OBLIGATIONS OF WAGE PORTAGE?

Despite the advantages of wage portage, this status does come with certain obligations.

The cost of wage portage

To benefit from true social protection, ported employees do not receive the full amount of their sales. As ported employees, their activity account allows them to convert their fees into wages (including employer and employee contributions).

Generally, the net salary before tax is around 50% of the amount paid by the client.

Minimum billing for wage portage

The regulations set a certain level of remuneration to guarantee that ported employees receive a minimum net monthly salary, after expenses have been deducted. Ported employees must therefore be paid a gross amount corresponding to 75% of the social security ceiling for a full-time equivalent (FTE).

Conditional access to unemployment benefits for ported employees

The Return to Work Allowance is paid if ported employees are registered as job seekers with the French Pôle Emploi employment service and have worked at least 910 hours (the equivalent of 130 days) in the last 24 months before the end of their employment contract for those who are under 53 years old. Beyond this age, the reference period which is taken into account is 36 months instead of 24 months.

Twenty-four months before the end date of the last contract

And 36 months for those who are 53 years and older

Restrictions on types of wage portage assignments

Wage portage is not permitted for commercial activities (buying and selling), personal services and regulated professions (lawyers, architects, notaries, certified public accountants, pharmacists, doctors, nurses, etc.) Only consulting professions are eligible for wage portage.